Headline:

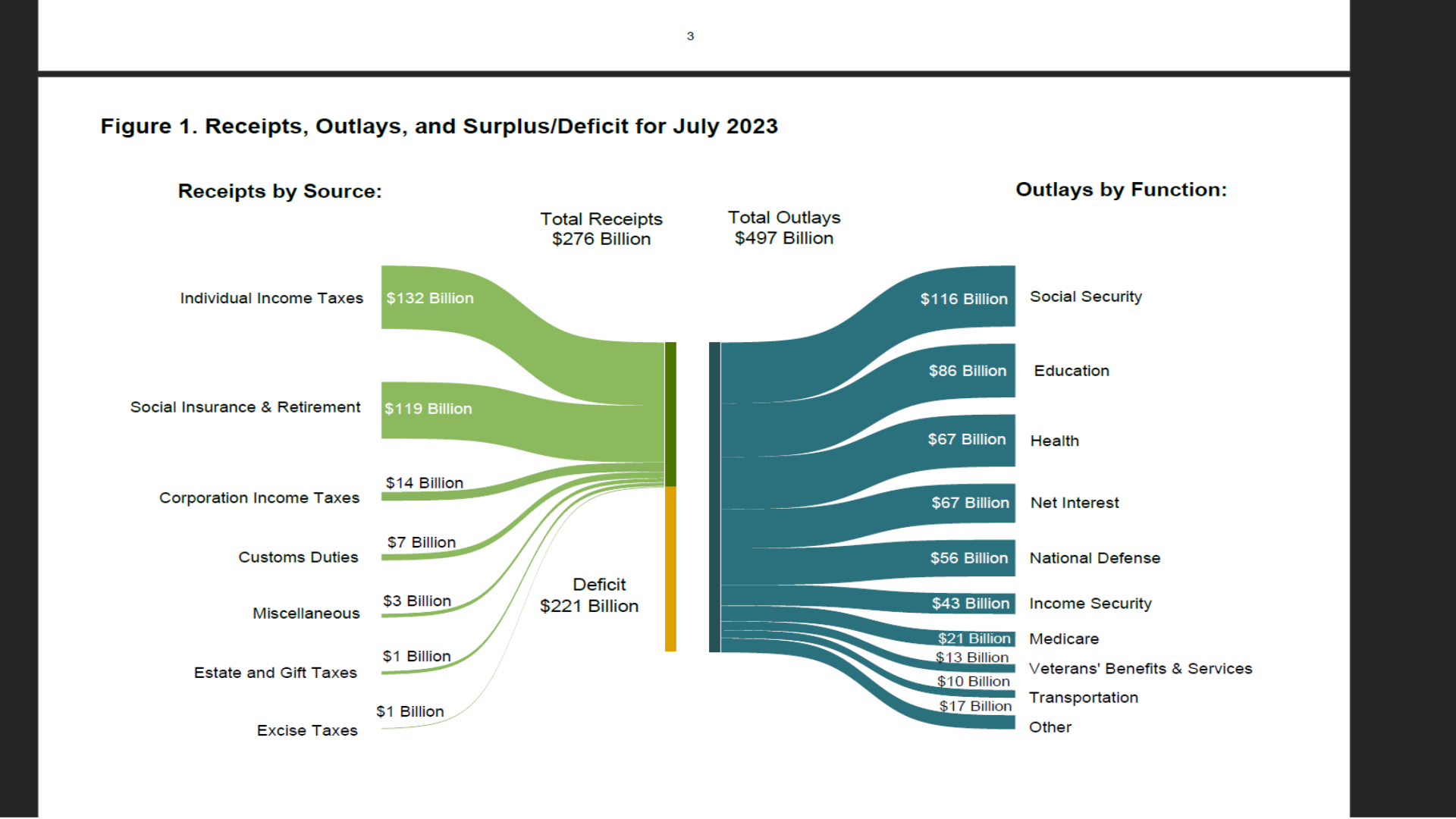

U.S. Monthly “Net Interest” Payments Exceed Defense Spending & Equal To Healthcare Expenditures.

*****************************

Dual U.S. Deficit + Debt Dilemmas = Well Understood By Financial Market Actors…

But Are Typically Dismissed As Illegitimate Concerns…Both Fiscal + Monetary.

*****************************

Nevertheless…Sharply Higher U.S. Debt Trends = Not Sustainable…

As “Net Interest” Payments For July ’23…Illustrated In Title Graphic = 4th Largest Monthly Federal Debit.

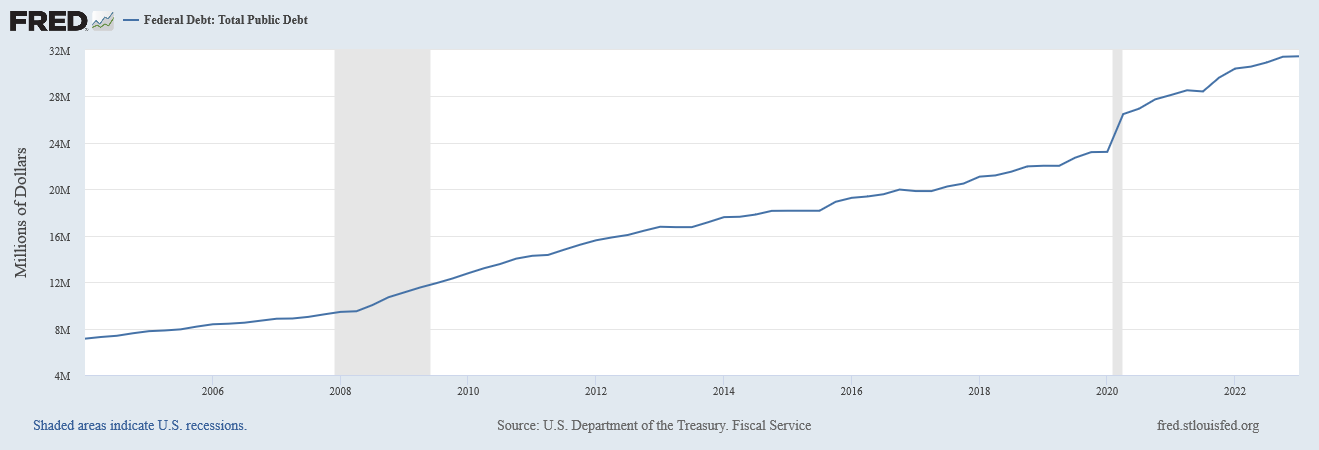

Monumentally Bloated U.S. Fiscal Deficits For 20+ Years…Continually Build + Stack The National Debt Burden…

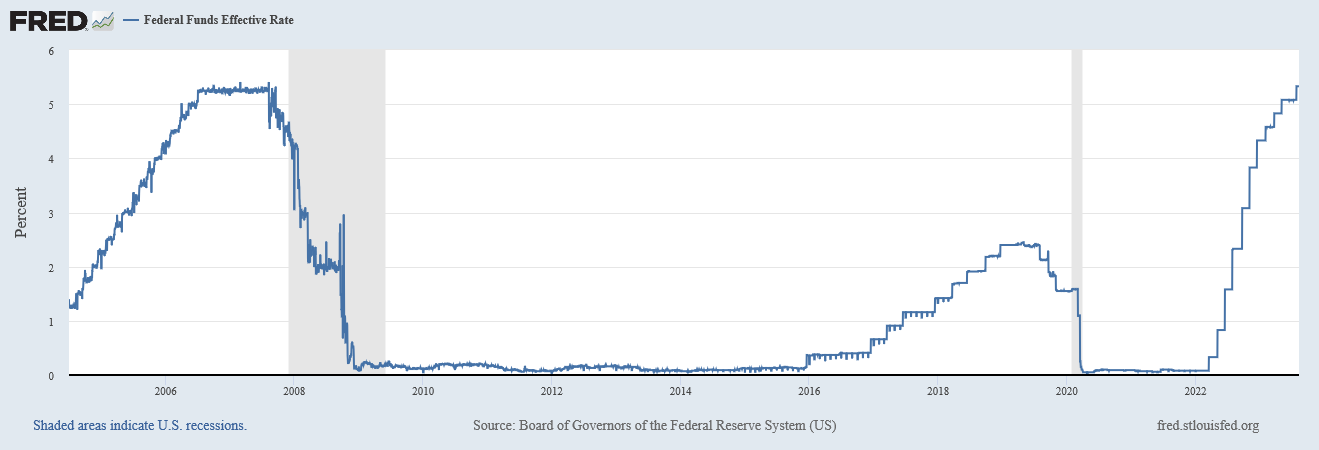

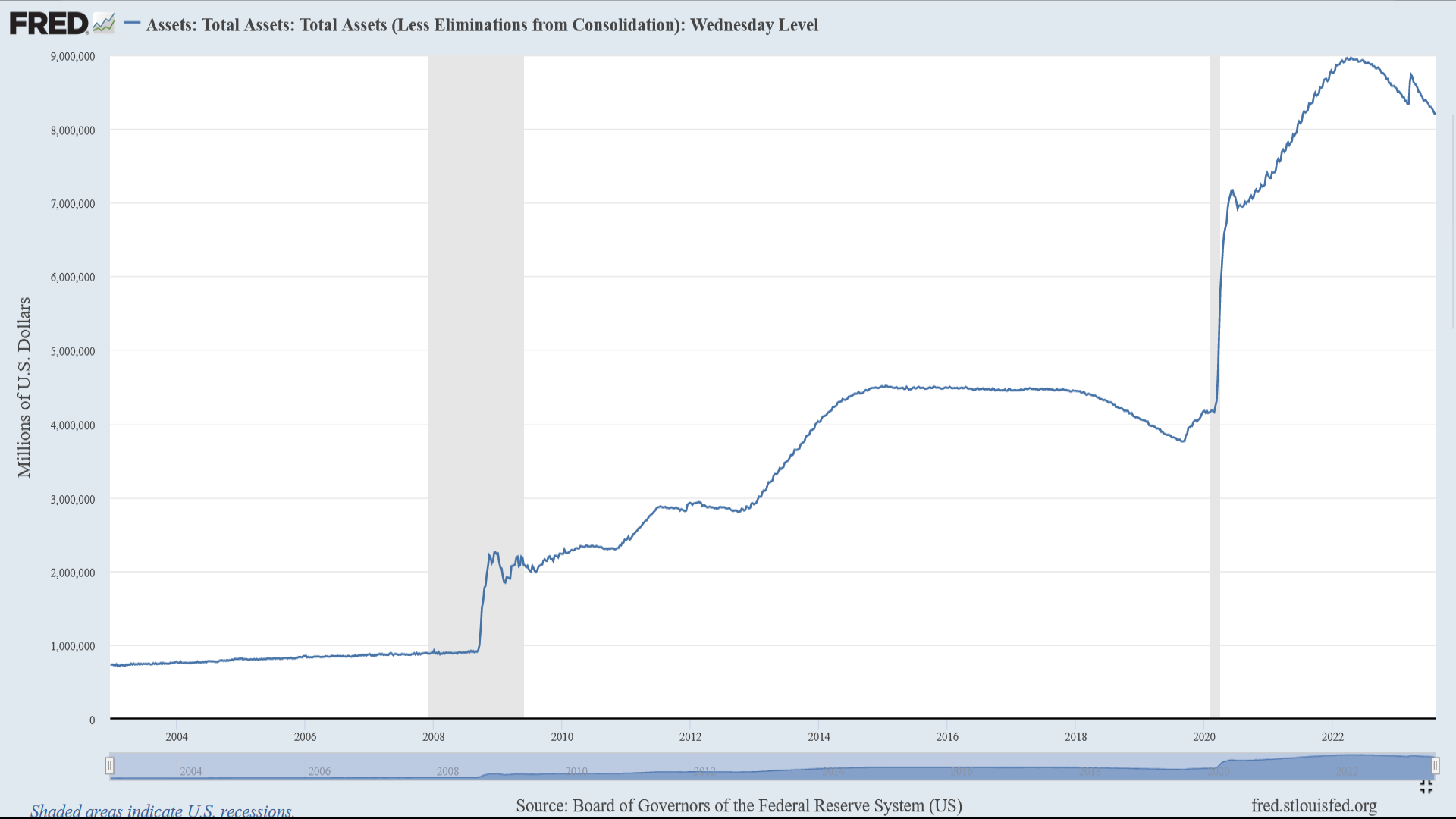

Though The Burden Was Masterfully Obfuscated By U.S. Federal Reserve “Debt Monetization” Policies…2009-2022.

*****************************

Thus…As U.S. Sovereign Debt Careens Higher…

Interest Costs To Service Debt…Coincidingly Bite + Ramp.

Federal Reserve Actions Compound The Fiscal Predicament By Bleeding Its Swollen Balance Sheet Into The Financial Markets…

All Of Which Increasingly Weigh On Fixed Income Asset Prices.

*****************************

Interest Payments To Service Debt = Sunk Costs…

Offering No Productive/Residual Value…

As Debt Is Nothing More Than A Debentured Tool…

Facilitating Demand Shift…From The Future…To The Present.

*****************************