FINANCIAL MARKET SNOW GLOBE = TRUMP’S HARD SHAKE

Headline:

Trump’s Chaotic Economic + Political Strategy.

**********************

The 24/7 U.S. Political Drama…

With It’s Substantial Economic Impacts…

Sure Is Dramatic + Entertaining.

But Not Sure Which U.S. Political Party…Thus Far…Has Been More Pathetic…

**********************

The Republicans’ Endless Victory Laps…

Proselytized By Conservative Media + Egomaniac Trump On Truth Social…

Or Donny T’s Ridiculously Heeling Henchmen…

Regurgitating Pre-Ordained “America First” Talking Points…

With Mechanical Stepford-Esque Style…

Their Blind Loyalty Soaking In Trump’s MAGA Kool-Aid…

Especially Trump’s

1. Annoying +

2. Defensive +

3. Forceful +

4. Loud +

5. Righteous

Female Mini-Me = White House Press Secretary Leavitt

Or

…The Democrats’ Constant Whining About The Deconstruction Of The Money Shredding Federal Administrative State…

As Their Front Row Seat To The Swift Dismemberment Of A Mostly Bloated Federal Bureaucracy Horrifies + Paralyzes Them.

**********************

No Doubt = These 2 U.S. Political Parties Are Idealogically Polarized…

As Any Cordial Political Co-Existence = Pipe-Dream…

Unless…Somehow Trump Becomes A Political Unifier…But Don’t Bet On It…

As His Scorched Earth And Shock/Awe Tactics To Dismantle DC’s Status Quo…

Combined With His Frequent + Public Humiliations Of His Political Opponents…

Only Widen An Already Gargantuan Political Chasm.

**********************

The Democrats…For Some Odd Reason…

Cannot Accept What The Republicans Have FINALLY Acquiesced To…

That Is…The Federal Government’s Grim Financial Reality…

For 24+ Years…Under Both Political Party’s Executive + Legislative Leadership…

Federal Spending Has Far Outstripped Federal Revenue…

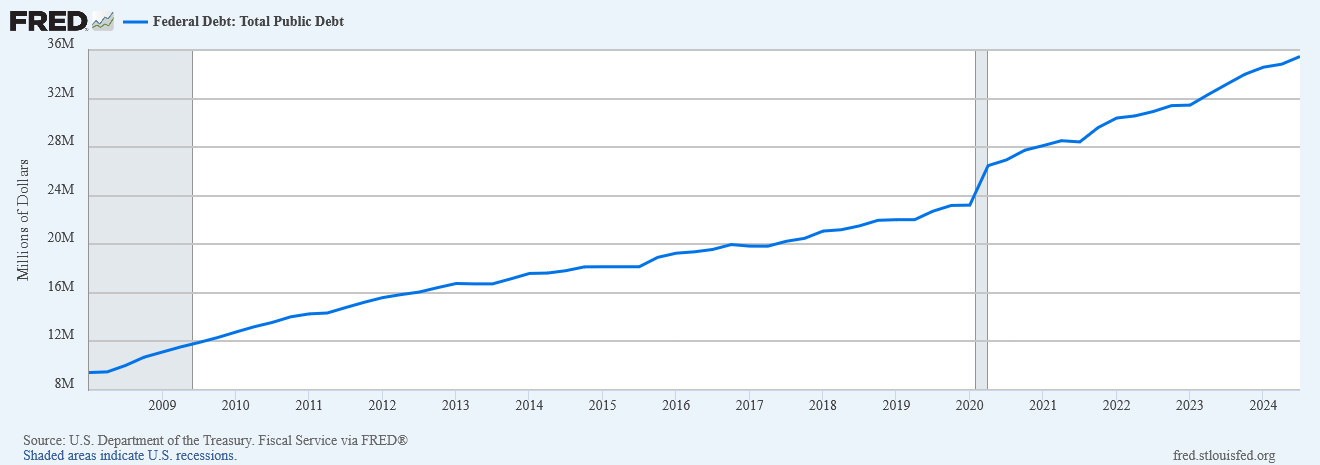

Continually Building A Mountain Of National Debt [$36T+]…

Now Even Greater Than Nominal GDP…

Requiring Active + Urgent Measures To…

At The Very Least…Minimize Annual Budget Deficits…

So That Aggregated Debt…Grows More Slowly…

Which…Even With DOGE…Will Be Difficult To Achieve…

As Annual Interest Payments On The National Debt…

Now Approximate $1T Or Close To 50% Of Recent Nominal Budget Deficits…

**********************

And Will Soon Increase = Hockey Sticking The Cost Of Debt…

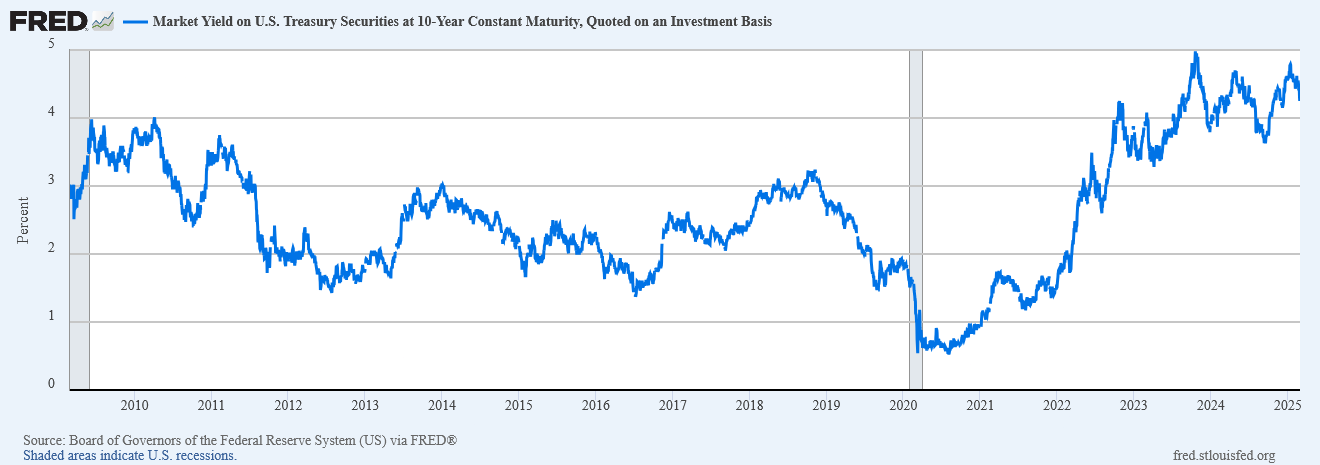

As Current Interest Rates [4%+] Tower Over Rates Attached To Previously Issued + Now Maturing Federal Debentures…

From 2010-2022…[See Below].

Plus…Higher U.S. Interest Rate Payments Are Compounded By An Ever Increasing Absolute Stack Of U.S. Debt [See Below].

Essentially A Double Edged Debt Sword…That Cuts Twice Deep =

Knee-Capping The U.S. Budget From Day #1 Of Each Fiscal Year.

**********************

Therefore The Democratic Party’s Desperate Quest To Clench Onto The Federal Government’s Prior Fiscal Standard =

Print Money + Spend Money…

Is A Much Flawed + Self-Immolating Strategy…

Because JOHN Q. PUBLIC… Naturally…Is Really Pissed Off…

That A Lot Of His Tax Dollars Were Carelessly + Idealogically [i.e. USAID] Spent…

As Already Demonstrated By DOGE’S $55B+ In Cost Saves…

Though Legitimate + Necessary + Tangible…

Are A Rounding Error When Contrasted To The $36T+ Stockpile Of U.S. Debt.

**********************

All Of Which Lays Bare A Convoluted + Murky Domestic/Global Economic Picture…

Certainly Transmitting To Almost All International Financial Markets…

Primarily Because Of Uncertainties Linked To Proposed U.S. Policies =

Some Of Which BRAKE The Economy=

1. Fiscal Spending Cuts +

2. Immigration +

3. Tariffs

And Some Of Which ACCELERATE The Economy

1. Deregulation +

2. Tax Cuts

**********************

Meanwhile…Perpetually

1. Opinionated +

2. Transactional

3. Victimized

Trump…Keeps Markets On Edge…

With Every Social Media Post + Spoken Word.

Media Spotlights Now Increasingly Shine On Foreign Leaders Too…

Addressing How They Intend To Reciprocate…To Proposed U.S. Tariffs And…

Quickly Shifting Overseas Sovereign Fiscal Plans…

Especially Europe…To Counter The U.S’s Surely Culled Monetary Support For NATO…

Re-Positioning + Reinvigorating Defense Budgets…That Have Atrophied For Many Years.

So…Fiscal Spending Priorities Are Drastically Pivoting…

Which For Any G-7 European Sovereign = Massive Economic Implications…

**********************

Ultimately…Markets Will Have A Clearer Sense Of U.S. Policy…

Allowing For More Aggressive + Directional Asset Price Positioning.

To That End…Until Very Recently The Bond Market’s Bet =

A U.S. Inflationary Impulse…

Primarily Tied To Trump’s Immigration + Damocles Sworded Tariff Policies…

Explaining Much Of The 10 Year Treasury Yield Launch…Its Highest Levels Since 2009 [See Above]…

A Yield Dynamic Initiated Just Prior To The U.S. Presidential Election In November ’24.

**********************

However…That Trade Has Recently Come Into Question…

And 10 Year Bonds Have Been Marginally Bid + Gaining Momentum…

As Last Week’s Typically Reliable Atlanta Fed GDP Estimate For Q1 ’25 Was Revised Substantially Lower…

From: +2.30% = Annualized Rate Of Growth…

To: -1.50% = Annualized Rate Of Contraction

…Equating To An Enormous Downside Revision.

**********************

Coupled With Recently Dismal Consumer Confidence Readings…

From Both The University Of Michigan + Conference Board…

And…S&P’s Flash U.S. PMI Commentary For February…

Which Was Particularly Bleak =

A Sour Recipe For Near Term U.S. Economic Activity.

**********************

Essentially…Consumers + Businesses Have Been Overwhelmed With A Tsunami Of DC “Snow Globe” Shaking…

Initiating…

1. Apprehensions +

2. Fears +

3. Uncertainties

…About Future U.S. Economic Performance…

Primarily Due To U.S. Policy Dynamics + It’s Wide Range Of Potential Outcomes…

Focusing…For Now…On The Bad Potential Outcomes Rather Than The Potentially Good.

So That The 10 Year Treasury Yield Has Retreated By 40 Basis Points …Since Trump’s Inauguration…

Is More Reflective Of U.S. Economic Growth Concerns vs. Reduced Inflation Fears.

**********************

Moreover…Trump Executive Order’s His Economic + Social Policies On All Americans…

Despite A Very Marginal Popular Vote Victory = 77.3M Vs. 75.01M…

Which…Incidentally…Is Neither A Mathematical Landslide Nor A Legislative Mandate.

Nevertheless…The Republicans Do Control…

1. The Executive Office +

2. Both Legislative Branches +

3. The Supreme Court

Which = Both Powerful + Rare.

So…Continue To Expect More…

1. Bullying +

2. Extorting +

3. Intimidating Tactics

From The U.S. President…On All Policy Fronts…Domestically + Internationally…

As His Idealogical Righteousness Only Ramps With His Number Of Days In Office + Political Allies’ Adulations.

**********************

Still…It Is Likely That Trump’s

1. Aspirational +

2. Expectational +

3. Preferred Outcomes

…For His Visioned U.S. Economy Characterized By…

1. Isolationism +

2. Nationalism +

3. Tariff-ism

Will Not Unfold Precisely As He And His Advisor’s Have Calculated + Mapped.

Transitions Of Any Type Are Always Potholed + Tricky…

Especially For The Globe’s Largest Sovereign.

Therefore…Almost All Economic Outcomes…Will Include…

Intended + Unintended Consequences…

Some Of Which = Negative + Some Of Which = Positive.

The Economic Magnitude Of The Ultimate Policy Transitions =

Nobody Truly Knows…Just Too Many Moving Parts…

As Well As…Currently…Not Too Many Stable Parts Either.

**********************

And In Spite Of The Administration’s Urgency To Tackle…What They Consider…

Countless + Legitimate National Issues/Problems…

In All Likelihood…Trump’s Executive Team = Spreading Themselves Too Thin…

Because Usually…

Too Much + Too Fast = Too Sloppy Outcomes.

**********************

But It Seems Trump Could Not Care Any Less…

As He Now Absolutely + Zealously Articulates The Reason His Life Was Spared From A Western Pennsylvania Rooftop Rally Shooter Last Summer =

Apparently…The Almighty Himself Saved Donny T. From That Volley Of Bullets…

So That Trump Could Specifically Fulfill His MAGA Political Agenda…

Which If Trump Truly Believes =

Is Quite Motivating For Him + Quite Scary For His Political Opponents.

So Brace Yourself…

For Many More Snow Globe Shakes To Come.

**********************

Protected: BOND + CURRENCY MARKETS PRICING FED POLICY MISTAKE

BOTH DEMOCRAT + REPUBLICAN FISCAL POLICIES = TRAIN-WRECKS

Headline:

Neither Political Party Has A Scintilla Of Fiscal Discipline.

******************************

Market Structures Are Broadly Defined By The Following =

1. Perfectly Competitive +

2. Oligopoly +

3. Monopoly

******************************

Governments [Federal + State + Local] = Necessary Monopolies.

And Since Monopolies Are Inherently Inefficient [i.e. No Competition]…

They Ought To Be As Small As Possible + Strictly Managed…

So Their Inefficiencies Are Minimized…

Thereby Enabling The Majority Of Capital To Flow Toward Competitive + Efficient Private Markets.

******************************

Consider The U.S. Government’s Monopolistic Financial Impacts On The U.S. Economy.

Most Recent Data Compiled By The U.S. Government’s Bureau Of Economic Analysis Estimates…

Q2 2024 Non Inflation Adjusted Annualized GDP = $28.652T+

Federal Government’s Annualized GDP Contribution = $1.865T Or 6.509%

State + Local Government’s Annualized GDP Contribution = $3.134T Or 10.938%

So…Combined = Total U.S. Government Contribution To GDP = $4.999T/17.44%.

******************************

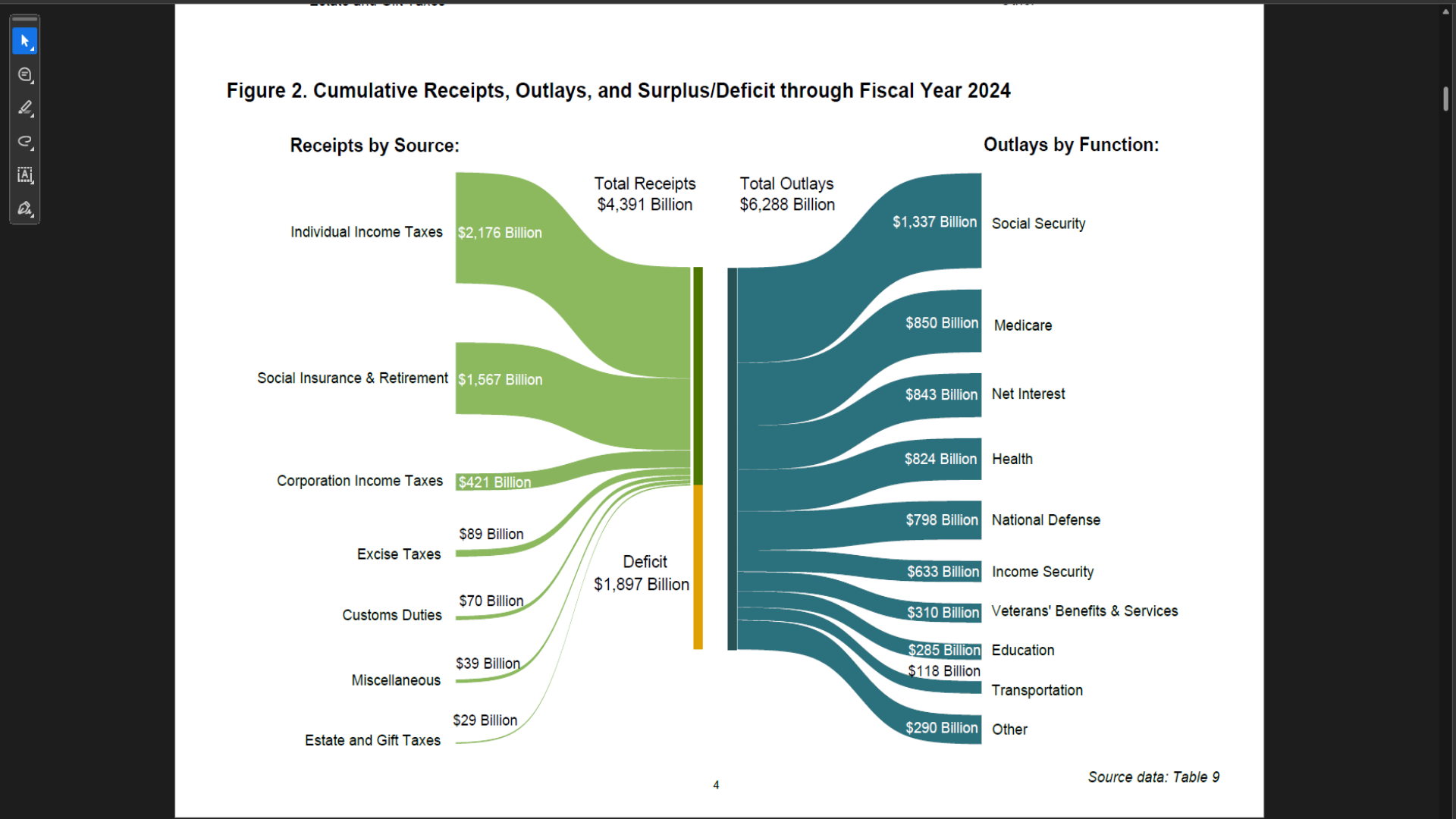

Also…According To The August 2024 U.S. Treasury Statement = Fiscal Year 9/24 To Date…

The P&L Of Just The Federal Government…With 1 Fiscal Month Still Remaining…

Has Generated A Deficit = -$1.897T…

Based On Tax Receipts = $4.391T

+

Total Federal Spend = $6.288T.

Almost Mirroring The Federal Governments Annualized GDP Contribution Of +1.865T…

Which = Pretty Darn Inefficient.

Yet The 2024 Federal Fiscal Deficit Is Not Idiosyncratic…

As Federal Deficits For The Prior 11+ Fiscal Years Are Also Consistent + Significant:

Fiscal 2023 = -$1.695T

Fiscal 2022 = -$1.375T

Fiscal 2021 = -$2.772T

Fiscal 2020 = -$3.132T

Fiscal 2019 = -$.984T

Fiscal 2018 = -$.778T

Fiscal 2017 = -$.665T

Fiscal 2016 = -$.587T

Fiscal 2015 = -$.439T

Fiscal 2014 = -$.483T

Fiscal 2013 = -$.680T

These Annual Deficits Compound To Build A Mountain Of Federal Debt…

Currently $36T…And Counting.

Naturally…The Debt Must Be Serviced…With Interest Payments…

Which Are Now The U.S. Federal Government’s Third Largest Budget Expense…

More Than Defense + Health + Approximating Medicare.

******************************

Further…Close Examination Of The Above Data Paint A Considerably Bleak Qualitative Picture Of The U.S. Government’s Spending Habits…

That Is…Entitlements + Giveaways = 67.41% Of Federal Spend.

So Basically The U.S. Federal Government Might Just Be…

THE WORLD’S LARGEST CHARITY.

Therefore…It Ought To Be No Surprise That This Bloated Monopolistic Charity…

Repeatedly Produces Enormous Budget Deficits.

******************************

Plus…These Fiscal Deficits…Unfortunately…Are A Gift That Keeps Giving…

Or More Accurately…A Gift That Keeps Taking Away…

As Serial Deficits Only Augment An Accumulating Federal Debt Load…

Certainly Contributing To Higher Long Term Interest Rates…

Increasing Borrowing Costs For Almost All U.S. Individuals + Businesses…

Federal + State + Local Governments Too.

******************************

And Although Sovereigns Have Power To Tax…

It Is Ludicrous That All Major Credit Rating Agencies Assign Investment Grade Ratings To Uncle Sam’s Debentures…

Especially Considering The United States’ Consistent + Un-Interrupted Budget Deficits For Almost 2 Decades…

Well Before + Subsequent To COVID.

******************************

Not Surprisingly…ALL Fiscal Red Ink Was Agreed To And Codified By The Legislative + Executive Branches Of Federal Government.

In Fact On Any TTM Basis Since 2001…The Federal Government Has Posted Fiscal Deficits…At Any Point On The 23 Year Timeline…

ORCHESTRATED BY BOTH DEMOCRATIC + REPUBLICAN…PRESIDENTS + CONGRESSES…

Thus…That Both Current U.S. Presidential Candidates Tout Any Fiscal Acuity And/Or Discipline…Is Plain Ridiculous.

Especially Since Both Served At The Highest Levels In The Executive Branch…

And One Also…As A U.S. Senator.

Frankly…It Appears Both Harris + Trump…

With Respect To The Fiscal Dumpster Fires They Both Ignored + Proliferated…

Are Either In Total Fiscal Denial…

Or More Likely…

A Pair Of Colossal Budgetary/Economic Idiots.

******************************

So…Rather Than Promoting Some Semblance Of Fiscal Austerity + Discipline To The Unsustainable U.S. Fiscal Trajectory…

Both Candidates Proudly Stump To SPEND MORE + MORE + MORE…

Toward Any + Every Special Interest Group…

Selling Their Influence To The Highest Bidder…

Domestic + Foreign…

And Whether Their High Priced Campaign Promises Are Ultimately Fulfilled Or Not = Irrelevant…

As Long As They WIN.

******************************

Furthermore…Both Candidates Cannot Seem To Grasp Onto A Basic Economic Principle…

That Is…Resources Are Finite…Especially Money.

And That There Is No Fiscal “Free Lunch.”

Rather…Fiscal Spending Must Be Massively + Necessarily Reeled In…

No Matter The Political Fall-Out…

Starting + Ending With The Lengthy List Of Entitlement Programs…

Which Can Be Immediately + Properly Addressed With A “Zero Based Budgeting” Approach…

That Neither Candidate…Probably…Can Either Define Or Understand…Let Alone Execute.

******************************

This Is Especially Unfortunate Because The Broad Contemporary Perception That The U.S. Government Ought To…

1. Bail Out +

2. Legislatively Address +

3. Remedy

The Majority Of Business + Societal Disputes/Issues/Problems =

NOT FISCALLY TENABLE…

Whether It Be Harris’ Classic Tax + Spend Democratic Tendency…

Blaming The Wealthy For Their Successes While Commanding The Affluent To Pay Their “Fair Share”…

Even Though The Top 5% Of Earners Already Pay 66% Of The National Individual Tax Total…

Or Trump’s Contorted Nationalistic Economic Policies…

That May Be Superficially Appealing [i.e. Tariffs] But Are Ultimately Inflationary To The U.S. Economy…

Although His Prior Campaign Mantra Of “Deconstructing The Administrative State”…

Resonates With Many.

******************************

Meanwhile…The Media Aggressively Fans The Political Battle Winds.

Advocacy Network Anchors Lecturing 24/7…

As To Why The “Other” Candidate Will Be A Political And Societal Disaster + Nightmare…

Regularly Wrapping The “Other” Candidate In A Cloak Of Fear + Uncertainty + Doubt.

******************************

In Stark Contrast…

I Was Not Yet Born When JFK Was Sworn In As The 35th U.S. President…In January 1961.

He Served For Just 2+ Years…Then Was Brutally Assasinated.

******************************

Still…A Singular Message From His Inaugural Address…More Than 63 Years Ago…

Recognizing The Humility + Limitations…Even Of A Powerful U.S. President…

Deserves A Giant Electoral Remembrance…

“ASK NOT WHAT YOUR COUNTRY CAN DO FOR YOU…ASK WHAT YOU CAN DO FOR YOUR COUNTRY.”

******************************

Considering The Collective Narcissism + Entitlement Expectations Of A Predominantly Mediocre American Population…

I Suppose Many Have Never Contemplated The Concept Of Actually Doing Anything For The United States…

To Improve The Nation…

Beyond Their Righteous + Selfish Motivations…

Such As…Serving In The U.S. Military…

Or Even Something As Simple As Picking Up Litter While Walking Or Hiking At A Local + State + National Park…

Perhaps…Even Becoming More Physically Fit + Healthy…

To Decrease National Healthcare Costs…

Since 75% Of The U.S. Adult Population Is Either Overweight Or Obese … According To The CDC’s Most Recent Body Mass Index Statistics.

But Maybe…It Ought To Be Considered…

Because The U.S.A. Requires More Courageous High Achievers [Personal + Professional]…From The Ground-Up To Leadership…

In Order To Dramatically Pivot From An Increasingly Bureaucratic And Wilting Status Quo…Fiscal + Societal…

To A Less Suppressive Ethos Strictly Encouraging Legitimate + Paramount Successes…

Where The Expected Standard = Excellence…

Rather Than Just Showing Up + Participating.

******************************